Embarking on the journey of securities investment isn't just about picking stocks or bonds; it's about strategically channeling your capital into assets with the potential benefits & returns of securities investment to grow your wealth, generate income, and secure your financial future. Whether you're aiming for a comfortable retirement, saving for a major purchase, or simply want your money to work harder for you, understanding the landscape of investment securities is a fundamental step.

Think of it like this: your money, left dormant, slowly loses purchasing power to inflation. Investment securities offer a proactive way to combat this erosion, offering pathways for capital appreciation and regular income streams that can significantly outpace traditional savings accounts. They form the backbone of both individual portfolios and vast financial institutions, playing a crucial role in economic growth and personal prosperity alike.

At a Glance: Key Takeaways for Smart Investing

- Diverse Avenues: Securities offer varied paths for growth, from company ownership (stocks) to lending money (bonds) and hybrid options.

- Two Main Goals: Seek capital appreciation (growth in value) or income generation (dividends, interest payments).

- Risk vs. Reward: Higher potential returns often come with higher risk; it's vital to match investments to your personal risk tolerance.

- Diversification is Key: Spreading your investments across different types of securities reduces overall risk without sacrificing growth potential.

- Long-Term Mindset: Many benefits accrue over time, leveraging the power of compounding.

- Stay Informed: Understanding market dynamics, issuer health, and regulatory frameworks empowers better decision-making.

What Are Securities, Anyway? (And Why Do They Matter to You?)

At its heart, an investment security is a tradable financial asset. It represents a financial claim on an issuer, whether that's a corporation, a government, or another entity. Unlike directly negotiated loans, investment securities are typically bought and sold through brokers or dealers in public or private markets, making them accessible to a broad range of investors.

For individual investors, securities offer distinct advantages:

- Capital Appreciation: The value of the security itself can increase over time, allowing you to sell it for more than you paid.

- Income Generation: Many securities provide regular payments, such as dividends from stocks or interest from bonds.

- Risk Management: By combining different types of securities, you can build a portfolio that hedges against specific risks.

- Portfolio Diversification: Spreading your money across various assets helps mitigate the impact of any single investment underperforming.

Essentially, securities transform your savings into working capital that can help you reach your financial goals faster than simply stashing cash.

The Core of the Deal: Understanding Securities Categories

The world of investment securities is vast, but it's typically broken down into a few main categories, each with its own risk and return profile. Knowing these fundamental types is your first step toward building a robust investment strategy.

Equity Securities (Stocks): Owning a Piece of the Pie

When you buy equity securities, commonly known as stocks or shares, you're purchasing a small piece of ownership in a company. This ownership comes with potential perks and responsibilities:

- Common Shares: Grant voting rights and entitle you to a share of the company's profits (dividends) and assets. They offer the highest growth potential but also carry the highest market risk, as their value fluctuates with the company's performance and broader market sentiment.

- Preferred Shares: Typically don't come with voting rights but offer fixed dividend payments, often taking precedence over common shareholders in receiving payments and in the event of liquidation. They blend some characteristics of both stocks and bonds.

Why invest in stocks? You're betting on a company's ability to innovate, grow, and increase its earnings, thereby increasing the value of your shares over time. Many long-term investors find that the growth potential of stocks is unmatched by other asset classes.

Debt Securities (Bonds, Fixed-Income): Becoming a Lender

Debt securities represent a loan made by an investor to a borrower (a corporation or government). In return for your loan, the borrower promises to pay you regular interest payments over a specified period and return your principal investment at maturity.

- Corporate Bonds: Issued by companies to raise capital. Their risk depends heavily on the company's creditworthiness. Investment-grade corporate bonds are generally considered safer.

- Treasury Bonds/Bills/Notes: Issued by national governments (like the U.S. Treasury). These are often considered among the safest investments due to the backing of the government.

- Municipal Bonds: Issued by state and local governments to fund public projects. They can offer tax-exempt interest, making them attractive to certain investors.

Why invest in bonds? They are generally less volatile than stocks, providing a more stable income stream and capital preservation, especially for those closer to retirement or with a lower risk tolerance. The risk varies significantly by the issuer's credit rating; highly-rated bonds offer greater confidence.

Hybrid Securities: Blending Equity and Debt

As the name suggests, hybrid securities combine features of both stocks and bonds, aiming to offer a balance of income and growth potential.

- Convertible Bonds: These are bonds that can be converted into a pre-determined number of common shares of the issuing company under certain conditions. They offer the steady income of a bond with the potential for capital appreciation if the company's stock performs well.

- Preferred Stocks: As mentioned above, while technically equity, their fixed dividends and priority in payments give them bond-like characteristics.

Why invest in hybrid securities? They can be a good choice for investors looking for regular income with some upside potential, or those who want to reduce overall portfolio volatility compared to an all-stock portfolio.

Money-Market Securities: Short-Term and Highly Liquid

These are short-term debt instruments designed for quick conversion to cash. They are generally considered very low-risk and offer modest returns, primarily serving as a place to park cash securely while earning a small amount of interest.

- Commercial Paper: Unsecured, short-term debt issued by large corporations.

- Certificates of Deposit (CDs): Time deposits offered by banks.

- Repurchase Agreements (Repos): Short-term borrowing for dealers in government securities.

Why invest in money market securities? They are excellent for maintaining liquidity for short-term needs, emergency funds, or as a temporary holding place for capital before deploying it into longer-term investments.

Unlocking the "Why": Potential Benefits of Investing in Securities

Now that we've charted the different types of securities, let's zero in on the compelling "why." What exactly are the benefits you stand to gain by putting your money into these financial instruments?

Capital Growth: Building Wealth Over Time

This is often the primary draw for many investors. Capital growth, or capital appreciation, occurs when the value of your investment increases over time. For stocks, this means the company's value grows, leading to a higher share price. For bonds, while less common, their market value can fluctuate, potentially allowing you to sell them for more than you paid before maturity, especially if interest rates fall.

The real magic of capital growth often comes from compounding. When your investments grow, and you reinvest the earnings, those earnings start earning returns themselves. Over decades, this snowball effect can lead to substantial wealth accumulation. It's why starting early, even with small amounts, can have such a profound impact.

Generating Income: Your Money Working for You

Many securities are designed to pay out regular income, creating a steady stream of cash flow directly to your pocket.

- Dividends: Paid by companies to their shareholders, typically quarterly. These are a share of the company's profits.

- Interest Payments: Paid by bond issuers to bondholders, usually semi-annually. This is the cost of borrowing money.

For retirees, income-generating securities can provide a vital source of funds to cover living expenses. For younger investors, reinvesting this income can supercharge the compounding effect, accelerating wealth growth.

Diversification: Spreading Your Risk

"Don't put all your eggs in one basket" is more than just an old adage; it's a cornerstone of smart investing. Diversification means spreading your investments across different types of securities, industries, and geographical regions. This strategy helps to:

- Mitigate Risk: If one investment or sector performs poorly, its impact on your overall portfolio is lessened by the stronger performance of others.

- Smooth Returns: A diversified portfolio tends to have a more consistent return profile over time, avoiding extreme highs and lows.

For instance, while stocks offer high growth potential, bonds provide stability. A mix of both can offer a balanced approach to risk and return.

Battling Inflation: Protecting Your Purchasing Power

Inflation is the silent thief of wealth, eroding the purchasing power of your money over time. If your money isn't growing at least as fast as inflation, you're effectively losing money. Investment securities, particularly growth-oriented stocks, have historically provided returns that outpace inflation, helping to preserve and enhance your purchasing power. Even debt securities, while generally offering lower returns, contribute by providing a yield that can at least partially offset inflationary pressures.

Liquidity: Access When You Need It

Many investment securities are highly liquid, meaning they can be easily bought and sold on exchanges without significantly impacting their price. This provides investors with flexibility, allowing them to access their capital when needed. Money market securities are specifically designed for high liquidity, making them ideal for short-term cash management. Even most publicly traded stocks and bonds can be converted to cash within a few business days.

Flexibility: Matching Your Financial Goals

The wide range of securities available means you can tailor your investments to align perfectly with your unique financial goals and time horizon.

- Short-term goals (e.g., down payment for a house in 3 years): You might lean towards lower-risk, more liquid investments like money market funds or short-term bonds.

- Long-term goals (e.g., retirement in 30 years): You might favor growth-oriented investments like stocks, which have more time to recover from market fluctuations.

This flexibility allows you to craft a portfolio that's as unique as your aspirations.

Calculating Your "Win": How Returns Are Measured

Understanding the potential benefits is one thing; knowing how to measure your actual success is another. Investment returns aren't always straightforward, but the basic principles are easy to grasp.

Capital Gains vs. Income Returns

- Capital Gains: These are realized when you sell an investment for a higher price than you paid for it. For example, if you buy a stock for $100 and sell it for $120, your capital gain is $20 per share.

- Income Returns: These are the regular payments you receive from your investments, such as dividends from stocks or interest payments from bonds.

Your total return is the sum of both capital gains (or losses) and income received.

The Simple Math of Annualized Return

While more complex formulas exist, a straightforward way to understand your return over a period is the annualized return. The general formula is:(Ending Value − Beginning Value + Dividends/Interest Received) / Beginning Value × 100

For example, if you start with $1,000, your investment grows to $1,080, and you receive $20 in dividends over the year:($1,080 - $1,000 + $20) / $1,000 × 100 = ($80 + $20) / $1,000 × 100 = $100 / $1,000 × 100 = 10%

Your annualized return would be 10%. This simple calculation helps you compare the performance of different investments over similar timeframes.

Beyond the Numbers: Total Return

Focusing solely on capital gains or dividends can be misleading. The "total return" perspective considers both aspects, giving you a complete picture of your investment's performance. A stock that pays a healthy dividend but barely grows might be a better total return than one that skyrockets in price but pays no dividend, depending on your goals.

The Other Side of the Coin: Understanding and Managing Risks

No investment is without risk. A trustworthy journalist doesn't just highlight the benefits; they also illuminate the potential pitfalls. Understanding these risks isn't about scaring you away, but about empowering you to make informed decisions and manage them effectively.

Market Risk: The Ups and Downs of the Economy

Also known as systematic risk, market risk refers to the possibility that the value of an investment will decrease due to factors affecting the overall market, rather than specific to a particular company. Economic downturns, geopolitical events, changes in consumer sentiment, or even a global pandemic can send entire markets tumbling. Equities are particularly susceptible to market risk.

Credit Risk: When Borrowers Can't Pay

This risk primarily affects debt securities (bonds). Credit risk is the possibility that the bond issuer (the corporation or government) will default on its payments, failing to pay back interest or the principal amount.

This is where credit rating agencies become your allies. Agencies like Standard & Poor's, Moody's, and Fitch assign ratings to debt issues, indicating their creditworthiness. Bonds with "investment-grade" ratings are considered less risky, offering greater confidence to investors compared to "junk bonds" or high-yield bonds, which carry higher credit risk but potentially higher returns. Due diligence into an issuer's financial health is paramount.

Interest Rate Risk: A Bond's Nemesis

For fixed-income assets like bonds, interest rate risk is a significant concern. When prevailing interest rates rise, the market value of existing bonds (which pay a lower, fixed interest rate) tends to fall. This is because new bonds are being issued at higher rates, making older bonds less attractive. If you need to sell your bond before maturity during a period of rising rates, you might have to sell it at a loss.

Other Considerations

- Liquidity Risk: While many securities are liquid, some niche investments might be difficult to sell quickly without a significant price discount.

- Reinvestment Risk: If you rely on income from investments and interest rates fall when your bond matures, you might have to reinvest your principal at a lower rate, reducing your future income.

Strategies for Smarter Risk Management

You can't eliminate risk entirely, but you can certainly manage it.

- Diversification: As discussed, spreading your investments across different asset classes (stocks, bonds, real estate), industries, and geographies is the single most effective way to manage risk.

- Asset Allocation: This is a strategic decision about how to divide your investment portfolio among different asset categories. Your age, financial goals, and risk tolerance should guide this. Younger investors might tolerate more stock exposure, while older investors might prioritize bonds for stability.

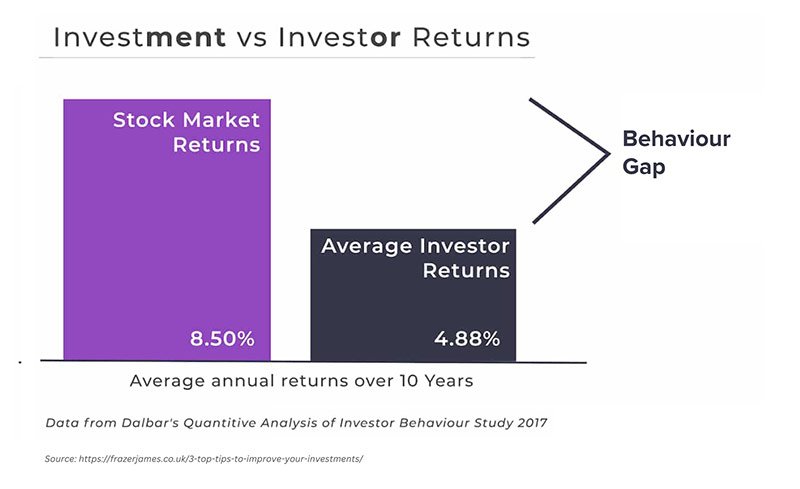

- Long-Term Perspective: Volatility is a natural part of the market. Attempting to time the market by buying low and selling high is incredibly difficult. A long-term outlook allows you to ride out short-term fluctuations and benefit from the overall upward trend of markets over decades.

- Regular Review and Rebalancing: Periodically check your portfolio to ensure it still aligns with your goals and risk tolerance. Rebalancing involves adjusting your asset allocation back to your target percentages by selling assets that have grown significantly and buying those that have lagged.

- Understand Before You Invest: Never invest in something you don't fully understand. Avoid high-risk, high-reward securities like IPO allocations, small gap growth companies, or complex derivative securities (like certain mortgage-backed securities) unless you have advanced knowledge and a high-risk tolerance. These are generally not suitable for typical investors or conservative portfolios.

Getting Started: Practical Steps for the Aspiring Investor

The world of securities investment can seem daunting at first, but with a clear roadmap, you can begin building your financial future with confidence.

1. Define Your Goals & Risk Tolerance

Before you invest a single dollar, know what you're investing for (retirement, house down payment, child's education) and your comfort level with risk. A comfortable investor sleeps soundly, even when markets are turbulent. If the thought of losing 10-20% of your portfolio keeps you awake, you have a low risk tolerance and should adjust your investment strategy accordingly.

2. Choose Your Investment Path

Most individual investors get started through:

- Brokerage Accounts: Offered by firms like Fidelity, Charles Schwab, Vanguard, or local banks. These allow you to buy and sell individual stocks, bonds, mutual funds, and exchange-traded funds (ETFs).

- Robo-Advisors: Automated, algorithm-driven financial planning services that manage your portfolio for you based on your stated goals and risk tolerance. They're often a great low-cost option for beginners.

- Financial Advisors: For more personalized guidance and comprehensive financial planning, a human advisor can be invaluable.

3. Do Your Homework

No matter your chosen path, research is crucial. Understand what you're buying.

- For Stocks: Look at a company's financial health, management team, industry outlook, and competitive landscape.

- For Bonds: Check the issuer's credit rating, maturity date, and yield. Remember, investment-grade ratings are a good indicator of lower credit risk.

- For Funds (ETFs/Mutual Funds): Examine their holdings, expense ratios, and historical performance.

Take the time to understand the value of getting SEC registration and regulatory oversight, as this provides a layer of trust and consumer protection within the market. This regulatory framework, primarily governed by Article 8 of the Uniform Commercial Code (UCC) for investment securities, ensures standardized practices and legal recourse, protecting both individuals and financial institutions.

4. Start Small, Stay Consistent

You don't need a fortune to start investing. Many platforms allow you to begin with just a few dollars, sometimes even buying fractional shares of expensive stocks. The key is consistency. Set up regular, automated contributions to your investment account, whether it's weekly or monthly. This strategy, known as dollar-cost averaging, helps smooth out market fluctuations over time.

Common Questions & Clear Answers

Let's tackle some frequently asked questions that often trip up new investors.

"Is securities investment only for the rich?"

Absolutely not. With platforms offering low minimums, fractional shares, and affordable robo-advisors, virtually anyone can start investing. The power of compounding makes even small, consistent contributions impactful over time.

"Can I really lose everything?"

While it's possible for an individual stock to go to zero, or for a bond issuer to default, losing everything in a well-diversified portfolio is highly improbable. Diversification significantly mitigates this risk. However, short-term losses and market corrections are normal, which is why a long-term perspective is vital.

"How much time does it take to manage investments?"

It depends on your approach. If you use a robo-advisor or invest in broad-market index funds, management can be very hands-off—perhaps an hour or two a year to review and rebalance. If you're picking individual stocks and bonds, it will require more ongoing research and monitoring.

"What about 'hot tips'?"

Be extremely wary of "hot tips" or promises of guaranteed, high returns. Legitimate investment opportunities rarely come in this form. Always do your own research and consult reputable sources. If it sounds too good to be true, it almost certainly is.

Your Next Steps: Building a Brighter Financial Future

Understanding the potential benefits and returns of securities investment is the first giant leap toward achieving your financial aspirations. You've learned that whether you seek aggressive growth through stocks, stable income from bonds, or a blend of both, the market offers a diverse array of tools to help you reach your goals.

Your actionable next steps are clear:

- Assess Your Current Financial Picture: Understand your income, expenses, savings, and debts. Create a budget.

- Define Your Investment Goals: What are you saving for, and by when?

- Determine Your Risk Tolerance: Be honest with yourself about how much volatility you can handle.

- Start Learning More: Read reputable financial news, books, and educational resources.

- Choose Your Investment Platform: Select a brokerage, robo-advisor, or financial advisor that aligns with your needs.

- Begin Investing Consistently: Even small amounts, regularly contributed, can yield significant results over time.

The journey of investing is continuous learning, but with this foundational knowledge, you are well-equipped to navigate the markets, harness the power of compounding, and move confidently toward a more prosperous financial future.